Earnings Pusle

article • Investment Management

Riddhiman Jain

2025-10-28 | 3 MINUTE READ

As we approach the Q2 FY26 earnings season, we maintain an optimistic outlook regarding certain sectors, including Non-Banking Financial Companies (NBFCs) specialising in gold lending, co-working spaces, quick service restaurants, life insurance, healthcare (comprising hospitals and diagnostics), as well as ferrous and non-ferrous metals. These segments are anticipated to deliver strong performance, driven by substantial earnings potential, a cyclical recovery, and a favourable macroeconomic backdrop. The Q2FY26 earnings season has started on a positive note, with 341 companies having declared results as of October 26, 2025. Since this accounts for less than 10% of listed companies, the current trends are initial and may change as more results are announced in the coming weeks.

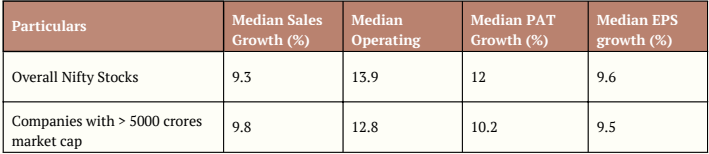

Initial signs indicate that companies with a market cap of over INR 5,000 crore are experiencing positive growth, with median sales increasing by 9.8% and profits rising by 10.2% year-over-year. Most of the earnings so far come from the IT and financial sectors, which are currently leading the way in disclosures this season.

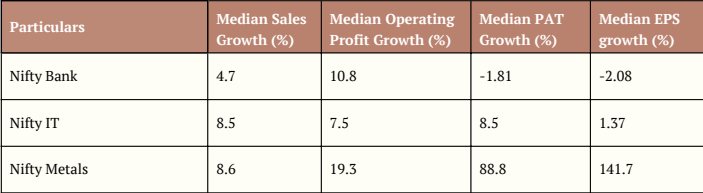

In the information technology sector, mid-cap companies are reporting stronger earnings than large-cap companies. Additionally, on October 21, United States Citizenship and Immigration Services (USCIS) clarified that current visa holders and students residing in the United States will not be subject to the previously mandated USD 100,000 fee (initially proposed on September 19, 2025). This development guarantees the continued presence of skilled professionals and students within the United States, thereby fostering a positive sentiment towards the Indian information technology sector.

For financial stocks, the expected rate cuts, improved liquidity conditions, and a surge in recent deal-making activity have collectively fuelled renewed investor interest in the sector. In the metals and mining sector, only a few companies have reported so far, with earnings largely in line with consensus estimates. However, management commentary across these firms indicates a benign outlook for the sectors.

Overall, according to management guidance, there is a projected sharp rebound in earnings, positioning the Indian equity market for a promising year with the potential for robust, double-digit returns. This development facilitates the subsequent growth phase within the market.