India’s Macro Story

article • Investment Management

Riddhiman Jain

2025-11-04 | 6 MINUTE READ

India’s triumph at the ICC Women’s World Cup serves as a proud symbol of focus, resilience, and balance — qualities that equally define the country’s economic momentum as we close 2025. From robust tax collections and revived consumption to a well-anchored bond market, India continues to demonstrate its capacity to adapt, absorb, and advance.

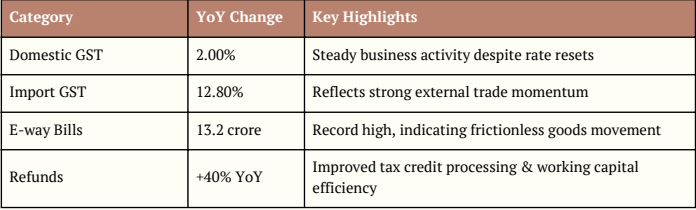

GST Resilience Amid Reform

India’s GST revenues for October 2025 surprised positively once again. Despite the sweeping rate rationalisation implemented in late September, collections stood at INR 1.96 lakh crore, up 4.6% year-on-year. This resilience reinforces the narrative that simplification and compliance, rather than rate hikes, are now driving fiscal buoyancy.

At the state level, Maharashtra, Karnataka, Tamil Nadu, and Telangana led with 6–10% growth, while smaller states showed limited divergence. The system’s rationalisation into two primary slabs — 5% and 18% — has enhanced predictability for both businesses and consumers.

Historically, rate adjustments (2018, 2019) led to short-term dips followed by sharp rebounds — and early signs indicate this cycle will be no different. With a full quarter’s post-reform data due by December, the fiscal picture should become even clearer.

For now, tax buoyancy remains the cornerstone of India’s macro stability, anchoring both fiscal confidence and investor sentiment.

While the GST reforms are encouraging, their real impact will be visible only after December. However, historical trends suggest that after the initial adjustment phase, rate rationalisation typically leads to higher revenues driven by improved compliance and greater efficiency.

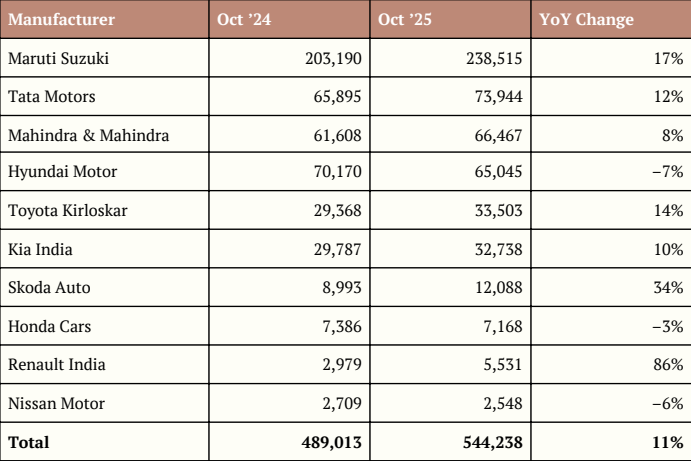

Auto Sales | Festive Tailwinds and Broad-Based Demand

India’s auto sector — a bellwether of discretionary consumption — extended its winning streak through October, with industry volumes up 11% YoY to 5.44 lakh units. Passenger vehicles led the charge, supported by festive sentiment, new launches, and steady financing conditions.

Key takeaways

- Market leaders like Maruti, Tata, and Mahindra gained share via refreshed models and agile supply chains.

- Skoda and Renault saw standout growth, reflecting improving rural and small-town demand.

- Financing conditions remain favourable as banks and NBFCs offer competitive loan rates.

- EV adoption continues to gather pace, particularly in metros.

Together, these dynamics show that consumption is broadening, not just rebounding — underpinned by rural stabilisation, improved credit access, and urban confidence.

Festive Demand

Festive demand has remained strong, with the Index of Industrial Production (IIP) for consumer durables rising 10.2% YoY, as manufacturers ramped up production ahead of the festive season. Two-wheeler sales jumped 27% YoY in September–October, supported by the recent GST cuts that have boosted consumption. Credit card spends were also up 23% YoY, reflecting steady demand. Other high-frequency indicators such as automobile sales, cargo traffic, and the RBI’s Consumer Confidence Index are showing early signs of improvement. After a subdued first half of FY26, we expect a sustained recovery in consumption, helped by the GST cuts and the RBI’s policy easing.

Manufacturing Sector Strengthened

India’s manufacturing sector strengthened further in October, with the PMI rising to 59.2 from 57.7 in the previous month. This improvement was supported by GST relief measures, better productivity, and higher investment in technology. New orders grew strongly, and output increased at a faster pace, mainly driven by domestic demand, while export orders rose more slowly.

Input costs increased only slightly, but selling prices continued to rise due to strong demand. Employment in the sector grew at a steady pace. Looking ahead, manufacturers remain optimistic, citing GST reforms, capacity expansion, and marketing efforts as key drivers. They also expect demand to stay firm and hope to close pending contracts soon.

Trade Balances

- India’s merchandise trade deficit widened to a one-year high of USD 32.1 billion in September, up from USD 26.5 billion in August, mainly because of higher imports

- Imports rose to USD 68.5 billion (+11% MoM, +17% YoY), driven by a surge in gold imports to USD 9.8 billion (+77% MoM, +107% YoY) ahead of the festive season and stronger oil imports at USD 14 billion (+6% MoM)

- 3. Exports also improved to USD 36.4 billion (+4% MoM, +7% YoY), despite the new US tariffs

- Exports to the US fell 20% month-on-month to USD 5.5 billion in September and are now about 32% lower than the USD 8 billion recorded in July, before the 50% US tariff took effect. However, because exports were front-loaded earlier in the year, exports to the US for the first half of FY26 were still 13% higher YoY (USD 46 billion vs USD 40 billion)

- Preliminary data suggests that some Indian exporters have been able to redirect shipments to Europe, the Middle East, and Asia to offset the impact of US tariffs. The sharp rise in exports to smaller markets such as Hong Kong and Bangladesh may also point to possible transshipment, though it’s too early to confirm this as a trend

- For the first half of FY26, total exports stood at USD 220 billion (+3% YoY) and imports at USD 375 billion (+5% YoY), leading to a trade deficit of USD 155 billion (vs USD 145 billion last year)

- The services surplus stayed stable at USD 15.5 billion in September, with the first half of FY26 totaling USD 95 billion (+13% YoY)

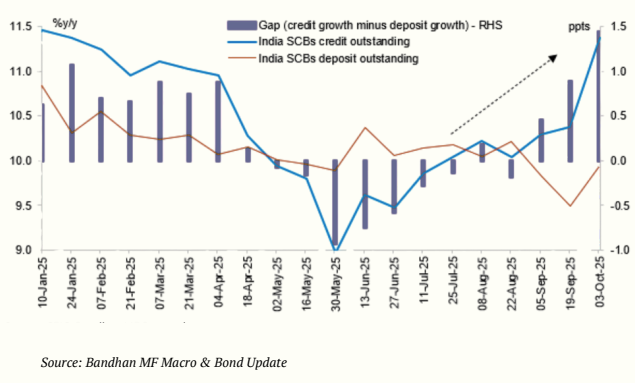

Macro & Bond Market Landscape

Global markets are in a phase of managed transition. After a period of dollar weakness, major currencies have stabilised, while US bond yields have cooled following improved fiscal math and tariff revenues.

In India, the RBI has stepped up rupee support to contain volatility, leading to a modest drawdown in domestic liquidity. While liquidity remains adequate, it is no longer in surplus.

The credit–deposit growth wedge has widened, signalling strong credit demand relative to deposit mobilisation. To ensure stability, the RBI is expected to resume Open Market Operations (OMOs) between December and March, potentially totalling Rs. 2 lakh crore or more.

This should help stabilise yields, especially in the 6–8-year maturity segment — which stands to benefit most from OMO activity. Corporate bond spreads remain tight amid limited supply, though incremental issuance could normalise spreads next quarter.

With policy rates near cycle lows and fiscal consolidation broadly achieved, the outlook is one of stability rather than further easing.

The introduction of a debt-to-GDP target band adds flexibility, balancing fiscal prudence with growth support — reinforcing market confidence.

Outlook | Resilience That Compounds

India enters the year-end with steady confidence:

- The GST framework has weathered reform without revenue disruption.

- Consumer demand is expanding across income tiers and regions.

- Festive spending and production picked up meaningfully, signaling a gradual but sustained recovery in consumption after a weak first half of FY26.

- Manufacturing activity remains strong, reflecting healthy domestic demand and continued expansion in production.

- The merchandise trade deficit widened on higher gold and oil imports, while the services surplus remained steady.

- The bond market reflects stability, not stress, as liquidity and yield management remain proactive.

With structural reforms deepening and domestic savings driving credit growth, the near-term narrative is not exuberance — but resilience that compounds.

Just as the World Cup champions embodied grit and focus, India’s macro story is one of balance — between reform and growth, stability and ambition.