Federal Reserve moves to measured cut for uncertain times

article • Investment Management

Riddhiman Jain

2025-09-18 | 4 MINUTE READ

The Federal Reserve cut interest rates by 25 basis points to 4.00%-4.25%, marking the first reduction in 2025, driven by a weakening labour market and slowing job growth. Fed Chair Jerome Powell described this as a “risk management cut”, emphasising that the decision was made after careful assessment of the economy and inflation pressures.

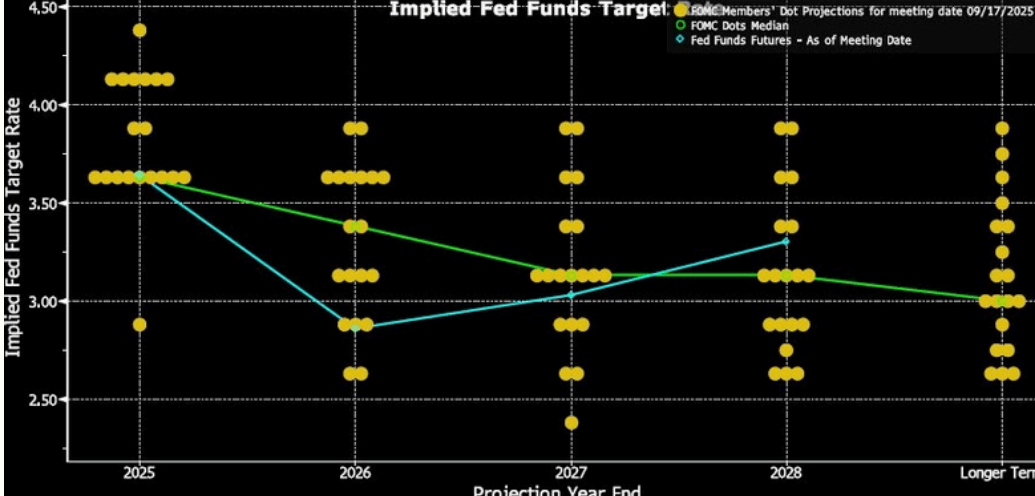

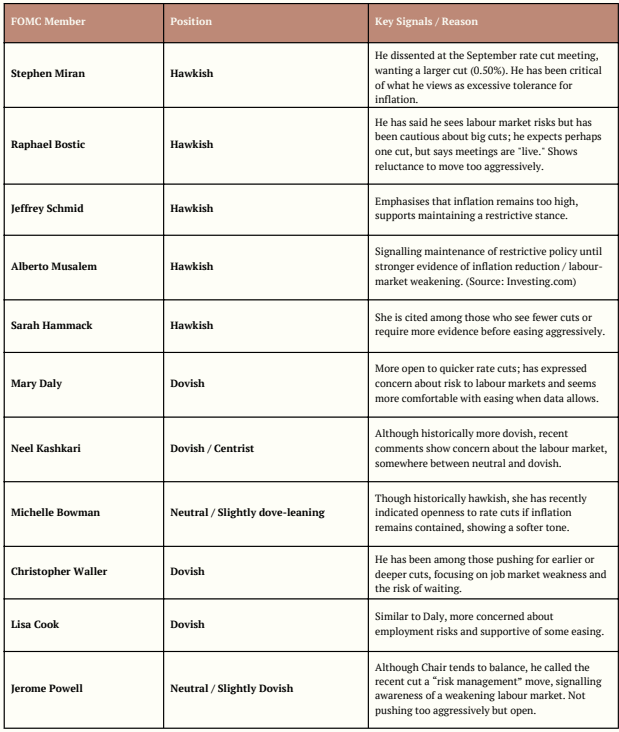

Powell noted the labour market is “really cooling off”, with rising unemployment and slower job creation, and the Fed remains data-dependent, prepared to adjust policy further if needed. The committee remains divided on the path ahead, with the median projection indicating two additional cuts this year. Still, members' forecasts range from none to as many as six additional reductions. Based on the latest inflation report, underlying price pressures in core services could pose a problem (tariff pass-through).

Still, the Atlanta Fed's GDP estimate for Q3 is 3.3%, which is a decent figure. Many observers describe the current backdrop as stag-flationary, though the jury is still out. In such periods, investors often turn to tangible assets like gold, real estate, and infrastructure, which can hedge against inflation and provide steadier income. However, with uncertainty surrounding the path of rates and inflation, the market impact remains unclear, necessitating a balanced and cautious approach.

U.S.Markets & Outlook

Given these comments, we reiterate our views across all asset classes.

- Equity: US valuations remain stretched, particularly in large-cap growth names where earnings expectations are elevated and leave little room for disappointment. However, small-and mid-cap segments are beginning to look more attractive after years of underperformance, supported by stronger domestic earnings momentum, cheaper valuations, and potential benefits from Fed easing.

- Fixed Income - U.S. Treasuries: With August’s rally led by the front end, we continue to see value in the 3–5 year segment, which offers attractive carry and benefits from Fed easing expectations without excessive duration exposure.

- Currency: The U.S. dollar’s downtrend is likely to continue, with Fed easing expectations and fiscal concerns weighing on DXY.

- Emerging Markets: For countries like India, the Fed’s rate cut brings mixed implications. A weaker U.S. dollar could attract foreign inflows and support local currencies, boosting sentiment. Equities may benefit from lower global interest rates and improved liquidity, although inflationary pressures and geopolitical risks warrant caution.

Key Decisions

- The Fed cut the federal funds rate by 25 basis points.

- The new target range for the federal funds rate is now 4.00% to 4.25%.

- This is the first rate cut since December 2024.

Rationale / Economic Context

Economic growth has moderated, with job gains slowing and unemployment creeping up (though still low). Inflation remains elevated. It has “moved up and remains somewhat elevated.” The Fed noted that downside risks to employment have increased.

Forward Guidance & Projections

The Fed signalled there may be additional rate cuts ahead (later this year), depending on incoming data and risks. Policymakers will carefully assess updates on the labour market, inflation, inflation expectations, and international/financial developments.

Dissent & Vote

Almost all members voted for the decision; one dissent by Stephen I. Miran, who preferred a larger cut (½ percentage point).