We will be old one day; Can we still be learning, working, and living?

The entirety of human beings’ innovations and technological progress is directly or indirectly focused towards one constant endeavour - to push death as far as possible.

Or inversely put, to live longer.

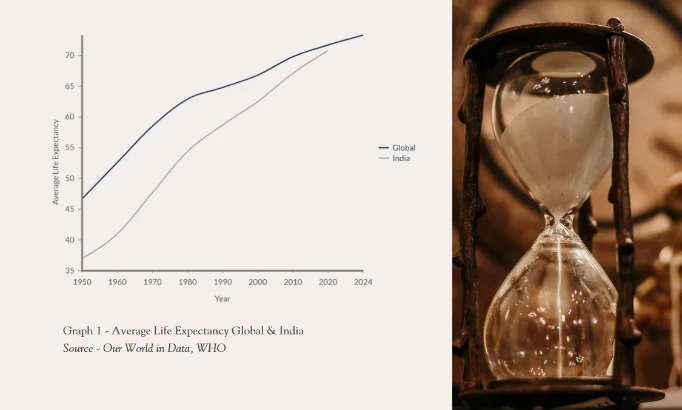

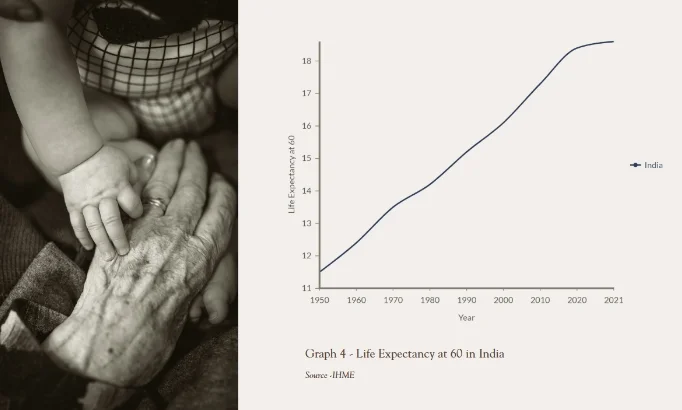

And we have been witnessing consistent success in this metric. From the Stone Age to today, with each passing year, we have pushed death a little further away. The developed nations did it first, but the developing ones are now following suit. In 1950, an average human could expect to live ~46 years. Today, we plan our lives expecting to live till 70.

And the number continues to rise further.

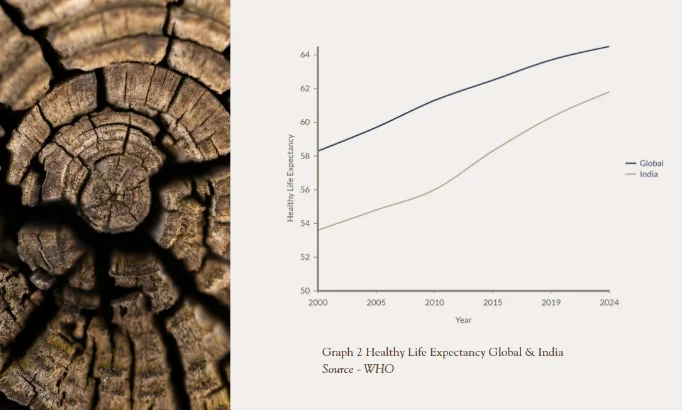

This trend may be broadly observed positively, but living longer has more nuanced implications. The most concerning is where ageing is both unproductive and unfit. Our endeavour should be not just to live longer but also to be healthy and productive for longer.

In the last 20 years, Healthy Life Expectancy (HALE) has grown, but not at the same rate as Life Expectancy (LE), with the gap between LE and HALE ranging from 7 to 10 years.

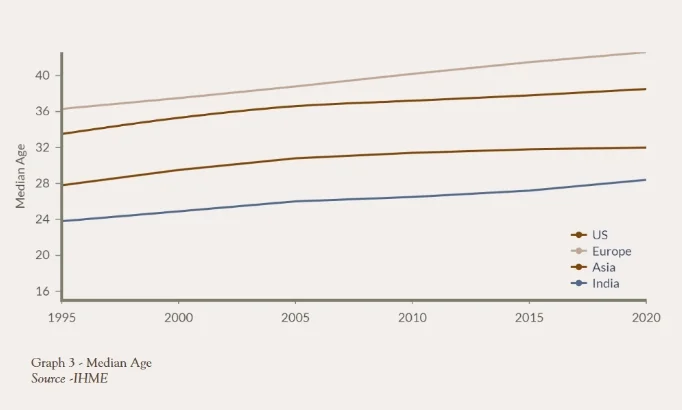

Today, the US and Europe have a median age of 40, indicating an ageing society globally. In India, the current elderly population (aged 60 and above) of 153 million is expected to more than double to 347 million by 2050.

The old-age dependency ratio in developed economies has grown from 19% to 30%, and the ratio for developing economies is fast rising. By 2050, the number of people globally over 60 is expected to more than double to 2.1 billion.

Historically, improvements in health and life expectancy have boosted economic growth. However, now, the fear is that an ageing society will have a negative economic effect, owing to a decrease in the proportion of the working population, increasing expenditure on pensions and healthcare, and rising government debt levels.

We will all be old one day, and while developing countries may boast of a younger population, it is important to realise that today’s youth is tomorrow’s elderly. But should an ageing society necessarily slow down economic growth? If we can live longer, healthier, and wealthier, longevity may as well be a boon and net positive for the economy.

All else being equal, longevity should lead to increased education, greater health investment, and higher personal savings. It should lead to similar or a higher consumption of leisure, entertainment, and travel in old age. A popular response to address the ageing society has been the rise of the silver economy, focused on the production and distribution of goods and services for people above 50.

I believe that if the Silver Economy is to prosper to become an Evergreen Economy, a shift in the perception of ageing is required.

What does that mean?

Here are some facets of an ‘evergreen economy’ that I believe can manage the adverse implications of living longer and lead us towards attaining the “longevity dividend”.

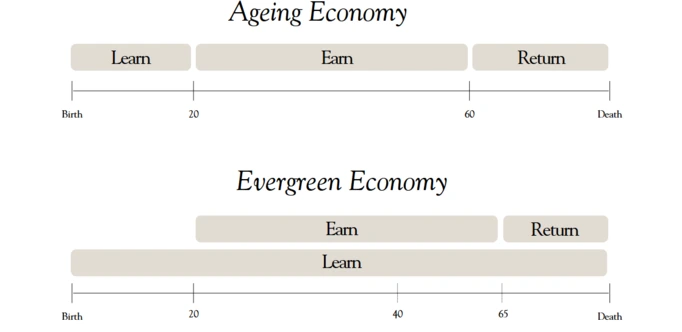

I. From ‘Learn, Earn, Retire’ to “Learn, Earn, Contribute”

Living longer implies longer working careers. Since 1950, retirement ages have increased from 55-60 years to 60-65 years across geographies. The OECD projects a two-year increase in the average effective retirement age by the mid-2060s. At the same time, rapid technological changes threaten to render many skills, and consequently many jobs for the older age working population to become obsolete, leading to a suboptimal impact of longer working careers.

Instead of stretching the ‘learn, earn, retire’ philosophy, it must evolve to include additional and adult education; and learning needs to become a lifelong habit. This requires businesses to innovate their recruitment, reskilling, and retention policies, which helps the older workforce to continue to contribute positively and productively to economic growth. WEF has estimated that 50% of all employees will need reskilling by 2025.

An upskilled population also widens the possibilities of not retiring and exploring part-time or freelance opportunities at an older age or even retiring before the state pension age.

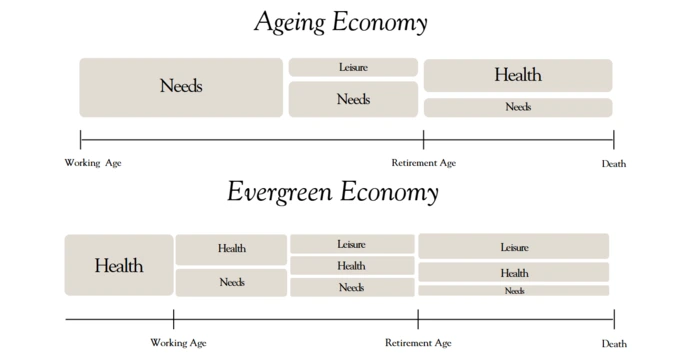

II. Reversal of Consumption Pattern

Traditionally, consumption in our lifetime has shifted from needs to leisure to health. As the global workforce moves towards a higher median age and the old age population rises, this consumption pattern will negatively impact production and economic growth. In a WEF report, in every developing economy, adults named medical expenses as their biggest financial worry. To attain a longevity dividend, this consumption pattern needs to be reversed.

To be able to spend on leisure in old age, health should be prioritised at earlier life stages. We need to focus more on preventing illness instead of treating it. Beyond physical health, both mental and financial wellbeing needs to be fostered from a younger age. Businesses need to prioritise both mental and physical health and wellbeing benefits for their workforce. Financial wellbeing is often ignored but cultivating positive habits in saving, investments and how to manage debts can have long term benefits for individuals.

III. Protecting the Purchasing Power of your wealth

In India, the probability of dying between 40-70 years has reduced from 35% in 1990 to 23% in 2020. Earlier, dying before the end of your productive age was a real risk, but as the age of death has been pushed farther, the probability of living into your 80s and 90s has increased. This trend implies an increasing number of years spent post-retirement, and hence, the risk is now of outliving one’s finances, skills, and health.

Protecting purchasing power is an important part of financial wellbeing and involves strategies to guard against inflation and that your money retains its value over time. Ways to do this involve investing in assets that appreciate over time, typically like equities, real estate, and gold/silver. Having an asset allocation strategy to invest in assets that are non-correlated is an important tool.

Insurance products need to evolve from managing the risk of dying too early to managing the risks of living too long. Apart from annuity-related offerings, a clubbing of health and wealth products could be the way to go forward, with innovative inflation linked products to protect purchasing power.

IV. Longevity Evolution for the Sandwich Generation

When we live longer, we will consume more of our wealth in our own lifetime, leaving less for the next generation. When we work for longer, we will hold on to senior positions for longer, restricting and delaying growth opportunities for the next generation. This pattern will increase the wealth gap between generations and lead to the rise of a sandwich generation - a generation clubbed between caring for ageing parents and growing children. Globally, the sandwich generation reports being financially strained and mentally stressed.

The sandwich generation crisis demands a holistic longevity evolution of the society that goes beyond health and pharma. Healthy, productive, and financially secure ageing will require a cumulative effort by multiple stakeholders – our employers, community organisations, healthcare providers, financial planners and advisors, government agencies, professional caregivers, educational institutions, and faith-based organisations. As we adopt and adapt to these societal changes, new business opportunities for the future will emerge.

The average human being living longer is a positive statistic. But the average human being living longer and healthier for longer is going to be the true measure of scientific and economic progress for our society. Continuing to contribute positively as we age, having a more holistic approach to our well-being from an early age, protecting the purchasing power of our wealth and the coming together of multiple stakeholders to address the realities of the sandwich generation, will ensure we truly benefit from the longevity dividend.

.webp)