The old adage “Time is money” no longer means what it used to. As traditional investments become a less efficient way of growing wealth, investors expect a lot more from their investments, advisors and funds managers. We’re all looking at the smartest ways of preserving and nurturing our wealth and today’s investor has access to exciting new avenues.

This is where Smart Beta Investing comes in to play ball. Now, the question of whether active management is better than smart beta management is as debatable as the chicken or the egg question. Like many other choices in life, one is not always better than the other. What works for one person’s portfolio may not work for others. That said, Smart Beta Investing is yielding impressive performance and it’s only prudent that we understand this better.

Meet Smart Beta Investing

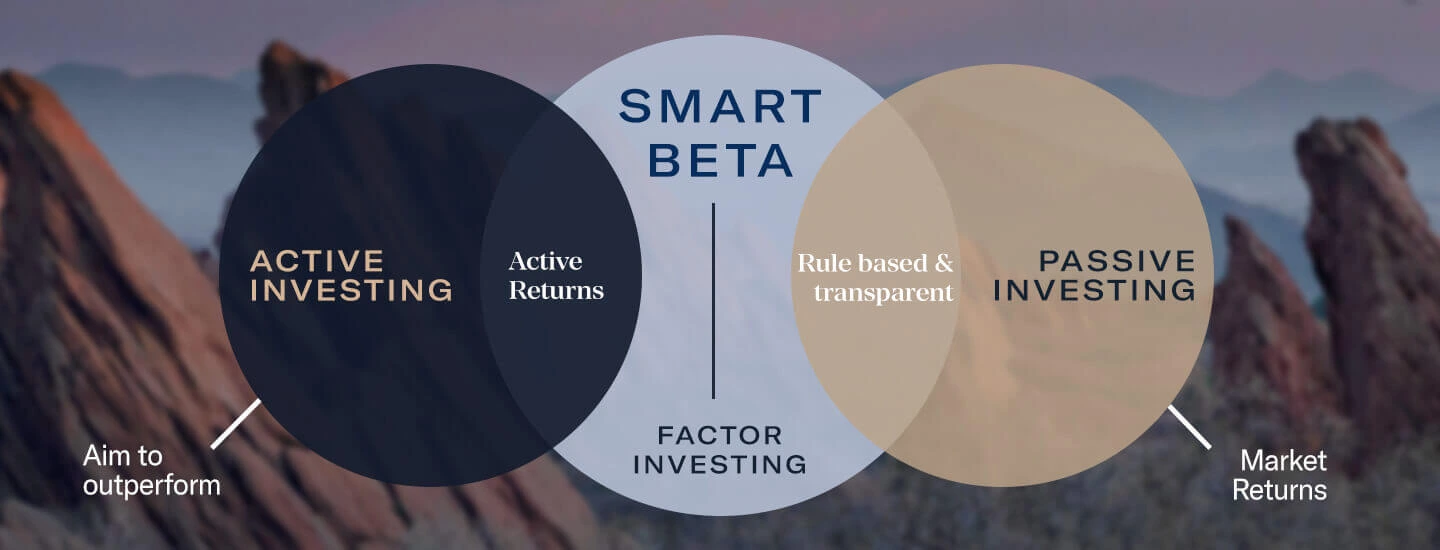

In principle, you probably already know that Smart beta investing offers a combination of active and passive strategies that gives you the benefits of both. In fact, many view it as the point where efficient market hypothesis and factor investing cross paths. Wait… what does that mean? Well, most traditional forms of investing, namely active management and index management are capitalisation-weighted. That means that the individual stocks within the index are based on each stock’s total market capitalization. Therefore, stocks with higher market capitalizations are weighted more heavily than stocks with lower market capitalizations. When it comes to smart beta investing there are many factors that are taken into account to pick specific stocks - we will discuss these factors later in this piece as well.

Women clients are very focused on goal-based investing. These goals can be for setting up a new line of business, setting aside capital for philanthropic causes, educating their children or supporting a comfortable lifestyle in their later years. Once these goals have been established, we have noticed that the investments themselves reflect a preference for products that have a higher degree of certainty for achieving these financial goals. Given the greater unpredictability of life events for women, ensuring greater reliability on financial outcomes is a very important criterion in investment decision making. This should not, however, be construed as a lower risk tolerance, which is often the mistake made by most wealth management firms.

The Third Pillar Of Investing

Outperforming active fund managers have become as rare as the white rhino over the past few decades. This has led to a rise in demand for transparent, rules-based investing. This has in fact become one of the secular trends of the asset management industry. Within the passive investment arena, alternatively weighted—or smart beta—strategies have witnessed remarkable growth. For example Nifty 200 Momentum 30 outperformed the benchmark, with a CAGR of 17.8% Vs 11.9% returned by Nifty 200 since 2005.

This is why Smart Beta Investing, which is well recognised as the third pillar of investing in most developed countries, is the talk of the town viz-a-viz UHNIs, HNIs and top money managers. Let’s take a moment to understand how smart beta investing works. Essentially, smart beta investing follows an index but it also picks a factor to select the stocks from the index.

In other words, a smart beta fund that tracks the Nifty 50 index would not select every stock in the index. There is a set of rules that are followed to pick specific stocks. This is why Smart Beta Investing may select only those stocks that exhibit a specific behaviour or a factor such as Low Volatility, Alpha or Momentum or combination of factors. Rather than relying solely on market exposure to determine a stock's performance relative to its index, smart beta strategies allocate and rebalance portfolio holdings by relying on one or more factors.

The Smart Beta Edge

The advent of factor based smart beta investing meant that, passive investors gained access to a broad range of exposures. Today, investors can access factors both individually and in combination through a range of ETFs, tapping into a world of sophisticated strategies that were once available only via active management. To illustrate this better, let’s look at some of the key factors that smart beta funds apply.

The first is volatility - stocks that are less volatile within the index get picked up over their more volatile counterparts. Then there is quality - a more difficult to measure aspect, quality of stocks is defined by looking at parameters like high ROE (Return On Equity), low debt to equity and a low variability in earnings. Another crucial factor is the alpha - this means stocks that have done well recently in terms of price performance will get picked. The next factor to consider is momentum which is again based on recent price performance and lastly there is value. Value is measured by looking at metrics such as price to earnings and dividend yield.

3 Key Benefits of Smart Beta Investing

Investors enjoy better performance as Smart Beta strategies try to outperform traditionally weighted index funds and active mutual funds or enhance a portfolio by reducing vulnerability to stock market volatility etc. Secondly, it improves diversification because stock selection is based on factors that diversify your portfolio by virtue of volatility, quality, momentum, value and size. Lastly there is the benefit of transparency and lower costs compared to most active fund managers.

In summary, there are many positives that come with Smart Beta Investing that most investors who like the rule-based approach are likely to lean towards.