5 Sustainability Trends that will shape human behavior For Earth in 2023

article • Investment Management

Kshitij Kumar Pandey

2023-01-11 | 10 mins

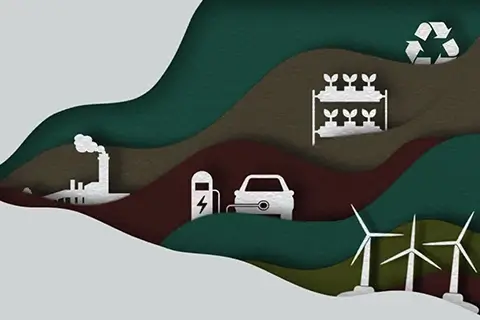

2022 has been a volatile year for the global sustainability movement. While COP27 laid the ground work for a historical loss and damage fund, the IPCC global climate report stated that the world would face unavoidable multiple climate hazards over the next two decades with global warming of 1.5°C (2.7°F). It goes without saying that climate change has become one of the hottest topics of 2022 and climate buzzwords such as Electric Vehicles, Veganism, Micromobility, Circular Economy, ESG, Greenwashing have dominated the media landscape. While the quantifiable results of these conversations have not been immediately positive, with most climate metrics continuing to head in a worrisome direction, it is essential for us to discuss, debate, and act on climate change with greater urgency. In that sense, every pillar of our society - from policy makers to investors to consumers - need to act collectively as well as individually to tackle what is quickly becoming an existential issue for us.

There is no doubt that social media and the tech disruption has helped in increasing conversation about sustainability. The Gen Z, or as we like to call them, ‘The Woke Investors’, are more conscious about their personal habits, as well as the ethics of the brands they associate themselves with. Global MNCs have been uninhibitedly scrutinized on social media for their large-scale carbon emissions, waste production and decades of unethical treatment of the planet that has contributed significantly to the situation we find ourselves in today.

Every year, the urgency of climate action is only going to increase, and the world will need to learn and adapt sustainable ways of living. Given our increased focus on true business sustainability, our team is constantly scouring the landscape and diving deep into the literature to better understand the climate movement.

Here is a list of 5 significant sustainability trends that we believe will be buzzing in 2023 and will hopefully shape human behaviour For Earth -

Greener Supply Chain

Given how significant the supply chain is in our economy, it is imperative that sustainable methods are adapted at all levels in the global supply chain. Companies are trying to ensure that their vendors and suppliers uphold ethical environmental standards.

Global supply chains will infuse more circularity in 2023. There are newer approaches to waste management, such as reusing the waste materials and returns by converting them into new products that can be sold once more, or by reusing parts of the waste as many times as their quality allows until they can be recycled.

This year, we expect ‘Green Packaging’ to be adopted across global supply chains. Overall, the sustainable packaging market was valued at $232 billion in 2020 and is expected to grow at 5.7% annually, crossing $306 billion by 2026. But in the last few years, the number of countries enforcing strict regulations on single-use plastics has more than doubled. And the tally of countries that have banned their use now exceeds 127. Accenture predicts that this model will generate an additional $35B of value from reduced costs in the consumer-packaged goods industry by 2030.

Woke Investors

As the global wealth transfer continues, the demand for organizations to become sustainable will keep growing. The portfolio of next gen investors is going to feature an increased allocation to impact investments. Companies will have to adapt to the belief system and values of ‘woke investors’ if they want to be a part of their portfolio. This rising tide of interest in sustainable lifestyles has been accompanied by an explosion of activity and innovation, with energy, mobility, construction, finance, packaging, and carbon capture being the biggest shifts towards a healthier planet.

There is enormous potential for impact investing decisions to play an integral role in the inter-generational wealth transfer. The next generation - family members between ages of 25 and 40 - are expected to be significant drivers of the discussion and adoption of impact investing as they try to align their social and environmental goals and value systems with their financial goals and investment thesis. In 2023, we expect that the majore roadblocks such as achieving buy-in from older generations, general lack of knowledge around impact investing, and limited expert support will all easen up as every pillar of the society starts integrating sustainability in their functioning and the positive impact of social capital becomes more evident. The woke investors will lead the way for impact investing models in the near future.

Greenhushing

2022 brought the harsh realisation that most of the loud sustainability campaigns by global brands had too little actual impact. Sustainability practices became a marketing opportunity for brands to ‘greenwash’ their historic and continued destruction of the planet’s resources. Unfortunately, they started being called out on social media and public forums. The consumers are now aware enough to differentiate between lipservice and a genuine effort.

Naturally, no brand wants to be labelled a greenwasher, and hence, in a classic case of a counter intuitive situation, as greenwashing accusations became louder, brands started reducing talking about their sustainability practices, which has led to a new issue - Greenhushing, aka Eco-Silence. Companies are becoming more cautious about launching an all-out campaign that harps about their sustainability efforts, but might actually put them at the heart of a potential social media debate, or in a regulatory conflict.

In a survey conducted by climate group South Pole, 27% of the 1200+ companies stated that they do not plan to talk about their climate strategies. This trend, which we suspect could grow in 2023, is not good news. We anticipate larger organisations to take genuine steps for the planet. For the global population, these actions, when environment-first in nature, form inspiring stories that heavily influence societal thought for earth. Greenhushing will bring fragmented information, and can actually create a big dent in the ongoing process of mass-scale climate awareness. Working in silence is not going to address the current situation.

Moreover, countries are increasingly becoming isolationists, which adds to ‘Greenhushing’ and further complicates the climate action because to protect our planet, we need strong global agreements, and the process of deglobalization doesn’t help that cause.

Brands need to continue conversations around sustainability, but with greater transparency and accountability, and with the sole intention of impacting the planet positively instead of hopping on the bandwagon for a few thousand likes. That is the only way to avoid greenwashing without greenhushing.

ESG Regulations

Ever since BlackRock released an open letter to the industry in 2020 about how each company should make addressing climate change a critical factor of how they operate, ESG has gained wide popularity. There are both critics and supporters, and though admittedly, ESG adoption still seems a long way to go especially in developing countries, it definitely leads to a positive impact. A study by The Economist found that companies with ESG targets generally had a lower environmental impact than those without such goals.

In 2023, we expect regulations around ESG to get firmer. The new Business Responsibility and Sustainability Report (BRSR) guidelines have made it mandatory for the top 1000 listed companies to report ESG information annually, starting financial year 2022-2023. However, rigid regulations would hinder investors from adopting ESG practices. The regulators have a crucial role to play here, to balance investor interests and ensure visible impact. A looming recession will test investors’ resolve to stay committed to their ESG strategy.

As per MSCI’s ESG and Climate Trends report, there are a few major factors that can shape ESG strategy in 2023 -

- Ukraine war & energy crisis will easen short-term pressure to reduce global greenhouse emissions

- Market restrictions around deforestation will get stricter, and companies will have to adapt

- Companies will step up effort on circular treatment of e-waste

- The alternatives for cotton, which degrades soil, and excessively consumes water, will be a global hunt among apparel retailers (high pressure on fast fashion brands to relook at the longevity of their products & designs)

Water conflict

Freshwater is a vital, yet unevenly distributed natural resource and a particular cause for concern given anthropgenic related pollution and salination. Fresh water makes up less than 0.05% of all water on Earth. Of this limited supply, potable water (fit for human consumption) makes up an even smaller percentage. Climate change, pollution and unsustainable groundwater consumption has led to significant water scarcity the world over. Given the vital nature of water, scarcity is increasingly leading to conflict as the control over access of a diminish water supply becomes more urgent.

Solving the water crisis is key to climate action and sustainable development. Apart from consumption and farming, water plays another vital role – climate moderation. Oceans are some of the largest carbon sinks in the world. In the last 200 years, the oceans have absorbed a third of the CO2 produced by human activities and 90% of the extra heat trapped by the rising concentration of greenhouse gases. This in turn, has led to significant ocean acidification, coastal salination and erratic ocean currents. Ocean warming is inevitably leading to further freshwater pollution (through salination) which is only adding to the overall scarcity.

While COP27 repeatedly proved that water and climate change are inextricably linked, Water did not stand alone as a topic. In 2023, we expect this to change, with Water becoming embedded in most global frameworks – a must have to ensure reduced transboundary water conflict – both nationally and internationally.

2023 has started with record breaking temperature rise in many regions, from France to Western Russia. Many countries in Europe experienced warmest January days yet. The time for stronger climate actions is now, and we hope these trends make 2023 a year of sustainable adoptions across industries.