In a first of its kind study, Waterfield Advisors and the India Impact Investors Council (IIC) have come together to present a comprehensive picture on the state of impact investing practices amongst family offices (FOs) and high net-worth individuals (HNIs) in India.

This report attempts to answer a variety of key questions such as:

Is impact investing a credible investment option?

How do FOs/HNIs view the trade-offs between risk, return and social impact?

What more can be done to catalyze larger flows into the sector?

Family office participation

FOs/HNIs are active in impact investment, but their overall contribution is yet to become meaningful.

83

No. of FOs/HNIs active in impact investing

279.5 million USD

The total amount of capital invested by Indian FOs/HNIs between 2016 and 2020. This amounts to only 3% of the total impact investing in India

Family office Retention

Out of 83 FOs/HNIs, only 20% continued investing in subsequent years upon their entry, whereas the remaining 80% discontinued or dropped off.

There is significant scope to increase retention of FOs/HNIs in impact investing.

Type of investment

FOs/HNIs seem to prefer direct investments into impact enterprises as compared to investing through impact funds. Almost 60% of total investments made into the impact sector has been made as direct investment, with the rest being made through impact funds.

Direct deals

164

million USD

Impact funds

115.5

million USD

279.5 million USD

Total FO/HNI contribution to impact investment

Stage of investment

Most FOs/HNIs invest small amounts at seed stage. A few committed ones are active in large-ticket, later stage deals

Seed Stage

43

(52%)4.7

(3%)million USD

Series A

14

(17%)20.5

(12%)million USD

Series B+

21

(26%)138.9

(85%)million USD

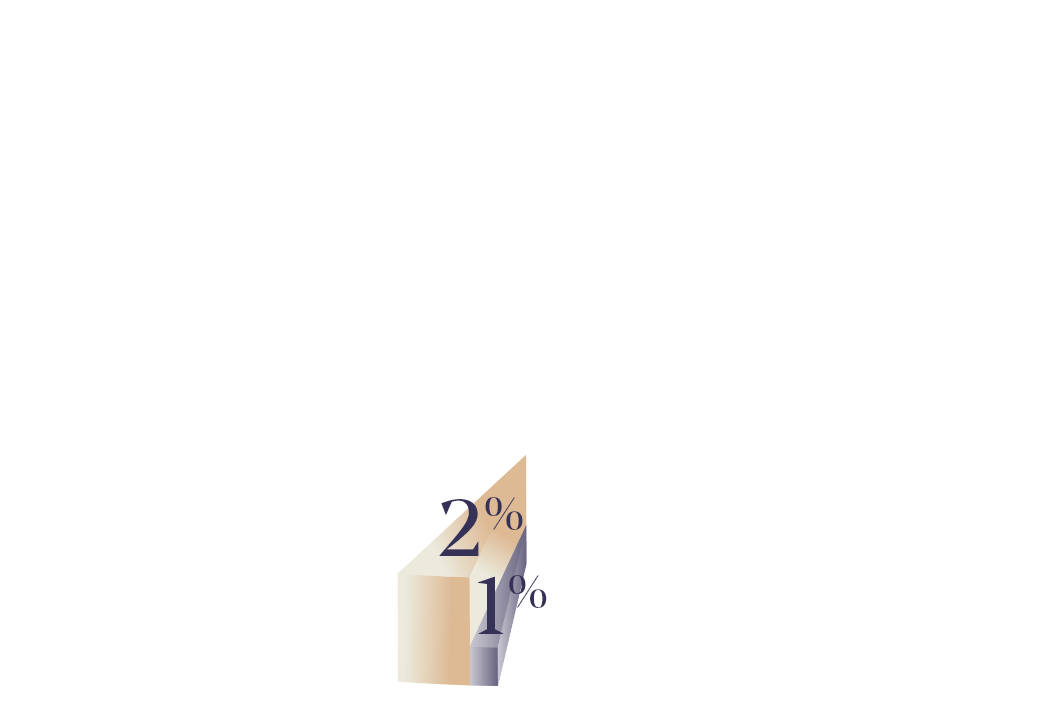

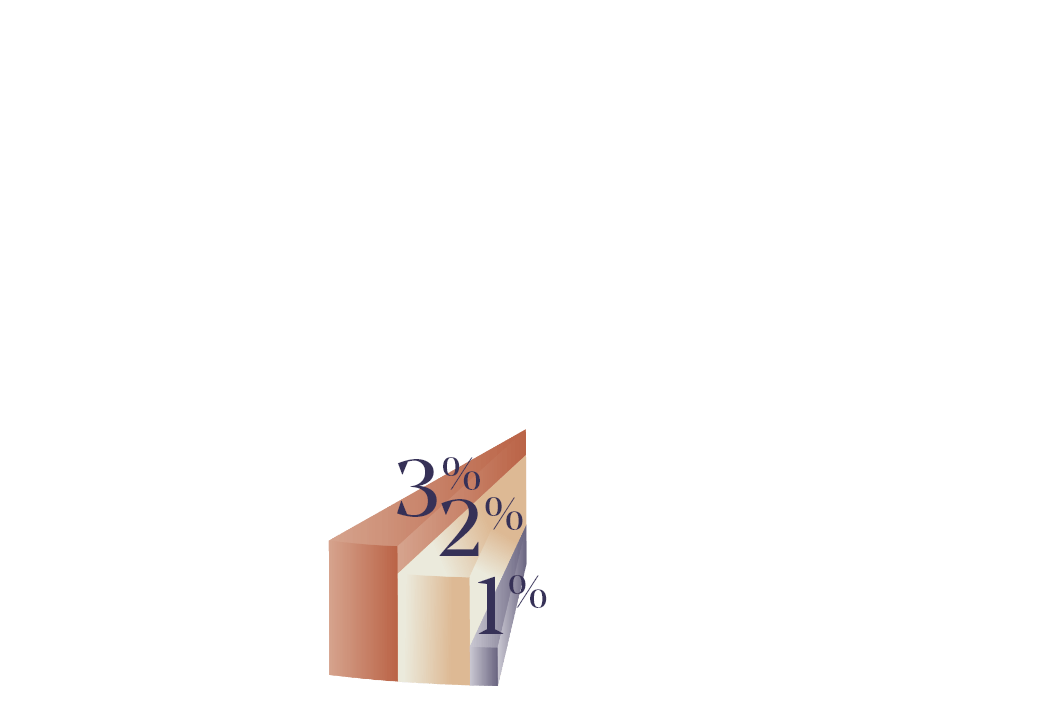

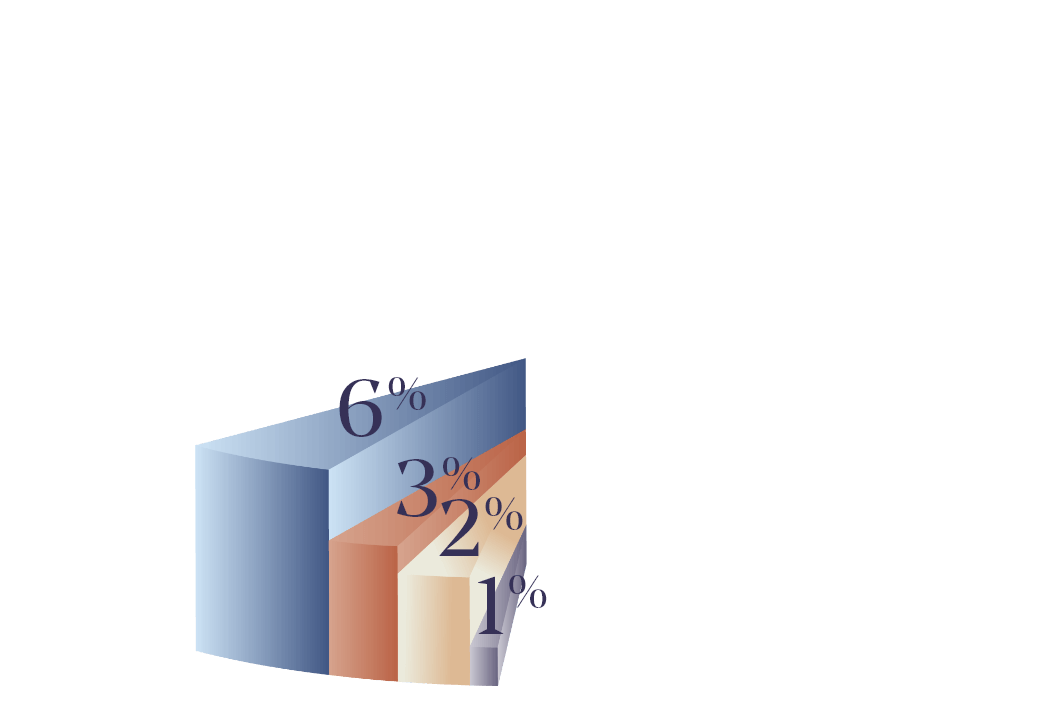

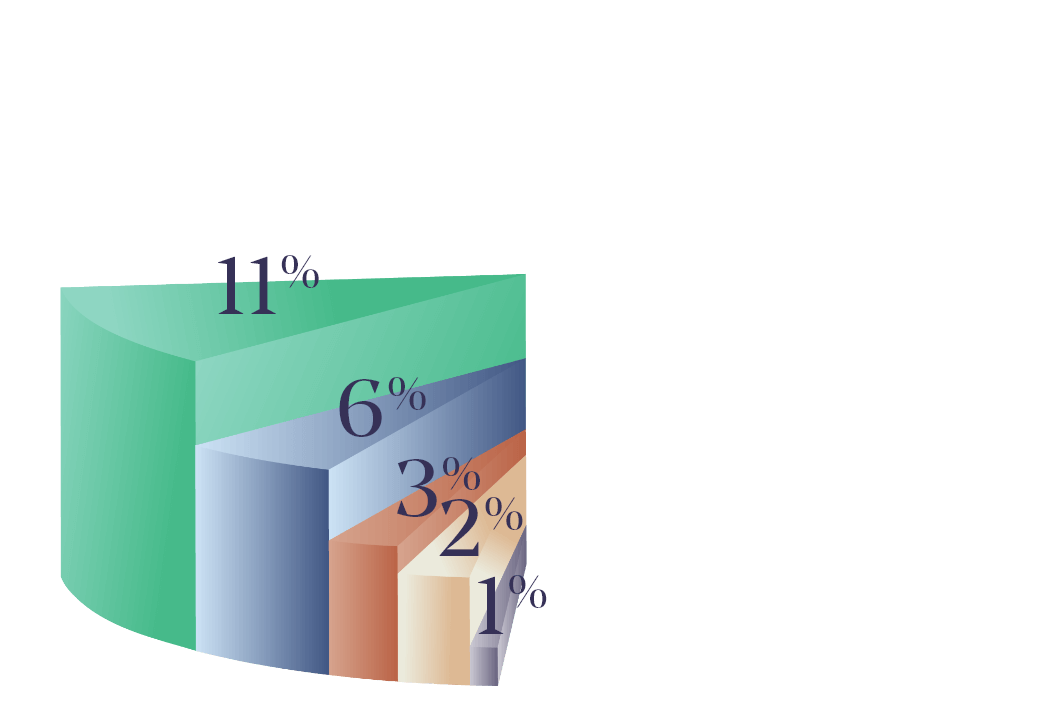

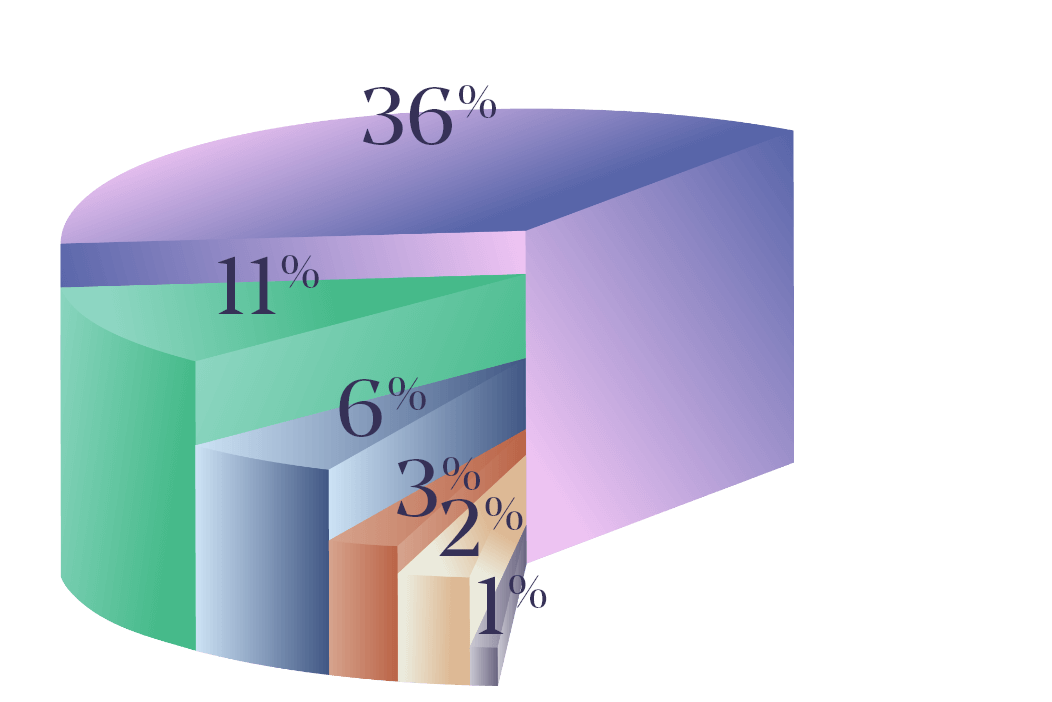

volume of investment by sector

While FOs/HNIs have invested across a variety of sectors, financial inclusion and healthcare seem to be more in demand and make up 50% of cumulative investments by volume

Other Sectors

Other Sectors

Education

Education

Agriculture

Agriculture

Technology for Development

Technology for Development

Healthcare

Healthcare

Climate Finance

Climate Finance

Financial Inclusion

Financial Inclusion

Attitudes towards return and impact

The community seems to be equally split through the middle on the topic of combining social impact and returns, with an opportunity to influence favorably with data and dialogue

Strongly agree or agree

Strongly agree or agree

Strongly disagree or disagree

Strongly disagree or disagree

Neither agree nor disagree

Neither agree nor disagree

Doing good should be philanthropic in nature and not make a return

41%

7%

52%

41%

7%

52%

Strongly agree or agree

Strongly agree or agree

Strongly disagree or disagree

Strongly disagree or disagree

Neither agree nor disagree

Neither agree nor disagree

Investments and returns can dilute the focus on social/environmental impact

38%

18%

43%

38%

18%

43%

Strongly agree or agree

Strongly agree or agree

Strongly disagree or disagree

Strongly disagree or disagree

Neither agree nor disagree

Neither agree nor disagree

I would rather make money from traditional investing and undertake philanthropic giving seperately

43%

11%

46%

43%

11%

46%

Strongly agree or agree

Strongly agree or agree

Strongly disagree or disagree

Strongly disagree or disagree

Neither agree nor disagree

Neither agree nor disagree

There is no trade-off between financial reports and impact

48%

11%

41%

48%

11%

41%

Strongly agree or agree

Strongly agree or agree

Strongly disagree or disagree

Strongly disagree or disagree

Neither agree nor disagree

Neither agree nor disagree

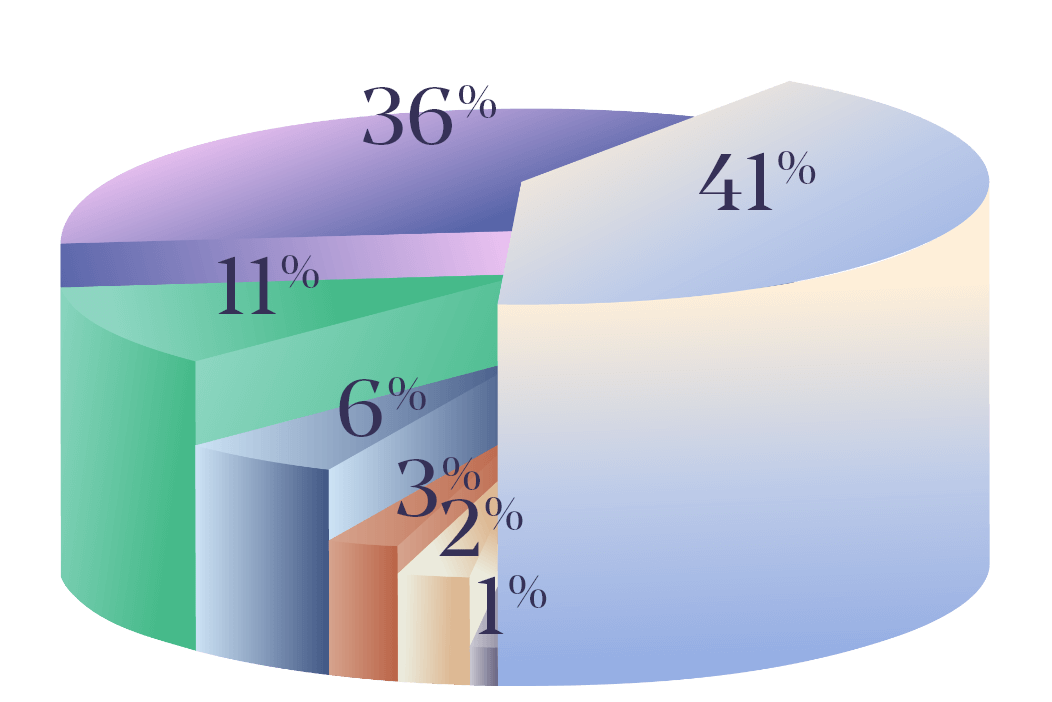

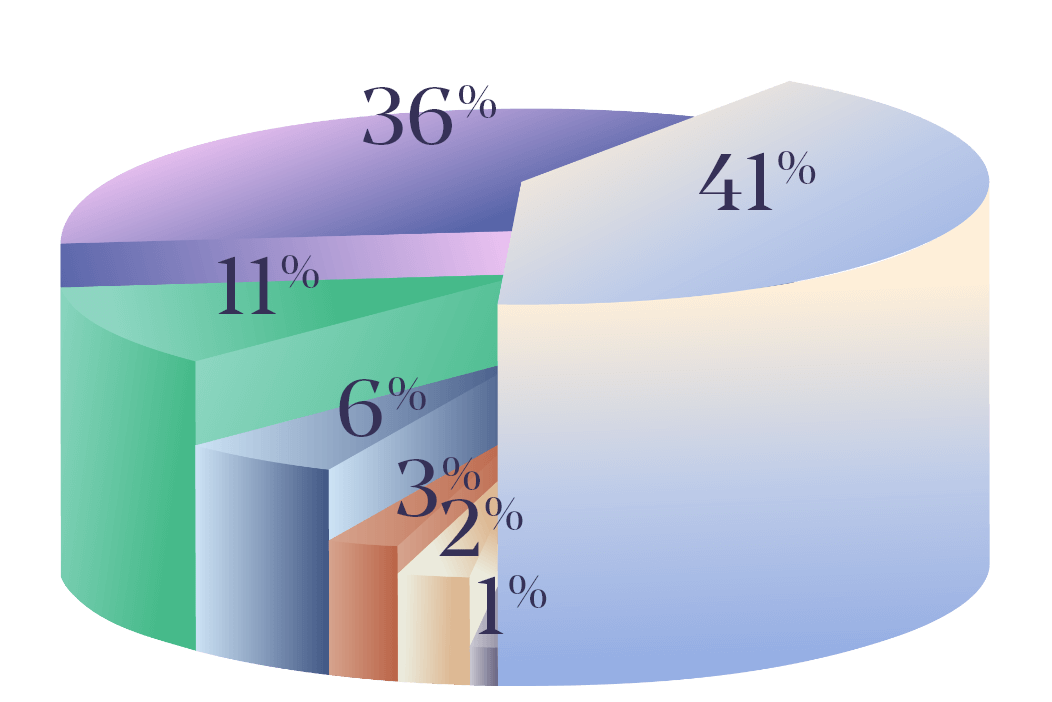

Return Expectations

FO/HNI expectations on financial returns more or less evenly distributed between risk adjusted market rate returns and below market rate 24% returns.

21%

24%

55%

21%

24%

55%

Below-market-rate returns: closer to market rate

Below-market-rate returns: closer to market rate

Below-market-rate returns: closer to capital preservation

Below-market-rate returns: closer to capital preservation

Risk-adjusted, market-rate returns

Risk-adjusted, market-rate returns

Top challenges faced by FOs/HNIs

The barriers or challenges could be categorized into two broad buckets – those related to the field of impact investment in general and those related to specific products/strategies.

Industry Wide Barriers

Industry Wide Barriers

Product Wide Barriers

Product Wide Barriers

Recommendations

Recommendations for FOs

- A broader approach of ‘capital for sustainable development’ can allow for multiple pathways to creating impact

- Defining an impact investing strategy aligned to one’s priorities could provide a purposeful direction

- Exploring a barbell strategy to investment could help balance the return-impact equation

Recommendations for the wider ecosystem

- Investing in education and capacity development can yield higher FO/HNI participation and retention

- There is an opportunity to expand the base of FOs by clearly highlighting social impact

- Creating diverse investment products across the risk-return continuum will allow family offices with differing preferences to participate

Archetypes

The study found widely differing views and preferences around impact investing as a strategy, broadly categorized into 4 categories.

The Champion

Early adopters with prolific track records, clearly delineated impact investment allocation and clear investment and impact thesis

Balanced return expectations with a preference for direct deals and willing to invest in early stages. Invests medium to large ticket sizes

The philanthropist- turned-impact investor

Experienced philanthropists, often with own foundations . Their motivation stems from achieving scale and sustainability of social/ environmental impact. Many have sectoral preferences. Focused on impact throughout the investment lifecycle

They are willing to take lower than market returns if impact is achieved. Willing to consider impact funds and direct deals. Invest medium ticket sizes in early stage if there is a mission match.

The explorer

Younger generation, more woke and aware. Still in the process of discovering and understanding impact investment. They are motivated by curiosity around impact investing.

These investors have balanced return expectations. Willing to consider impact funds and direct deals. Invest relatively smaller ticket sizes.

The commercial investor

Traditional PE/VC investors. Generally, sector agnostic. These investors may or may not have a separate impact thesis

These investors have risk adjusted market returns. Willing to consider impact funds and direct deals. Invest medium ticket sizes and prefer to come in at slightly later stages and help investees scale

Fill in the details to download the report